Demystifying Payroll (PAYE) A Guide for Business Owners

Managing payroll is a crucial aspect of running a successful business. As a business owner, understanding the intricacies of Pay As You Earn (PAYE) and implementing effective payroll processes is vital for both your company and your employees. In this guide, we’ll explore what PAYE is, why it matters, and how you can ensure seamless payroll management.

Understanding PAYE

PAYE, or Pay As You Earn, is a system of income tax withholding that ensures taxes are deducted directly from employees’ salaries before they receive their pay. This system is designed to collect income tax and National Insurance contributions in a systematic and timely manner.

The Components of PAYE

- Income Tax: PAYE includes the deduction of income tax based on employees’ earnings. The tax bands determine the rate at which income tax is deducted, ensuring a fair contribution from employees based on their income levels.

- National Insurance Contributions (NICs): In addition to income tax, employees and employers are required to make National Insurance contributions. NICs fund state benefits, including the state pension and healthcare.

- Student Loan Repayments: If applicable, PAYE also includes deductions for student loan repayments. Employees with outstanding student loans have a portion of their pay withheld to repay these loans.

The Importance of Accurate PAYE Processing

Accurate and timely processing of PAYE is essential for several reasons:

- Compliance: Adhering to PAYE regulations ensures that your business remains compliant with tax laws. Non-compliance can result in penalties and legal consequences.

- Employee Trust: Transparent and accurate payroll processing builds trust among employees. They rely on their employers to handle their taxes and contributions correctly.

- Avoiding Penalties: Late or incorrect submissions of PAYE information can lead to penalties. Regular and accurate reporting helps avoid such financial setbacks.

Ensuring Smooth PAYE Management

- Invest in Payroll Software: Consider using payroll software to automate the PAYE process. These tools can calculate deductions accurately, reducing the risk of errors.

- Stay Informed about Regulations: Tax regulations and allowances can change, so staying informed is crucial. Regularly update your knowledge or consult with a tax professional to ensure compliance.

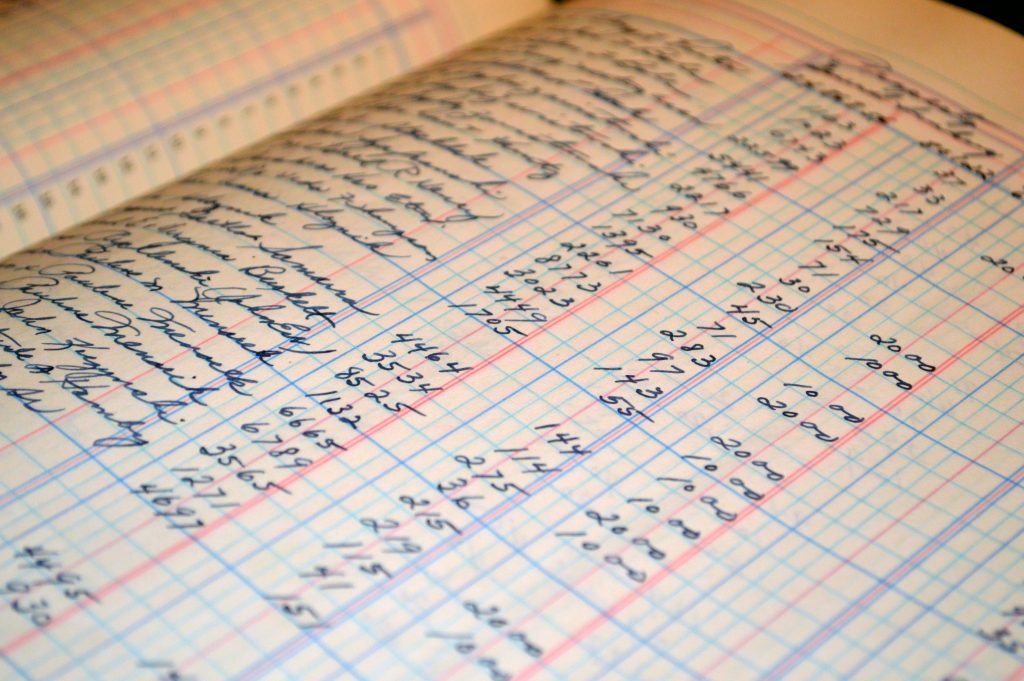

- Keep Accurate Records: Maintain detailed records of employee earnings, tax deductions, and National Insurance contributions. Accurate record-keeping simplifies audits and ensures transparency.

- Seek Professional Assistance: If managing PAYE becomes complex or time-consuming, consider seeking the services of a professional accountant. They can provide expert guidance and handle the intricacies of payroll processing.

Conclusion

In the world of business, understanding and effectively managing PAYE is a fundamental responsibility. Accurate processing not only ensures compliance with tax laws but also fosters trust among employees. By investing in the right tools, staying informed about regulations, and maintaining meticulous records, you can streamline the PAYE process and contribute to the financial health and success of your business.